Citizen Lobby Day

Monday, March 23, 2015

9:00 AM to 4:00 PM

Location: Texas State Capitol

Address: 1100 Congress Avenue

Austin, TX 78701

(meet on the South Capitol steps)

Go to the TURF Registration Page to Register…

Your freedom to travel is at risk!

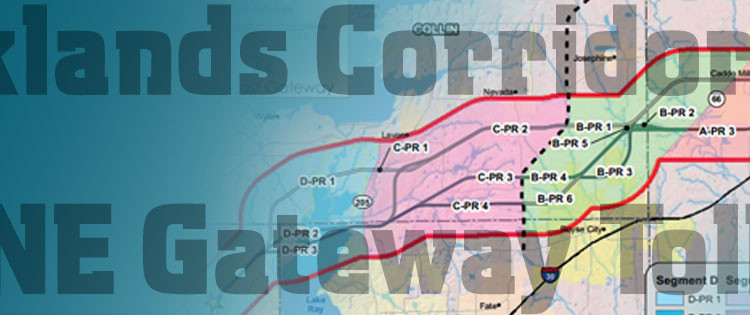

Concerned citizens from across the state will gather in Austin to interact with lawmakers on transportation-related issues. We’ve seen a massive increase in our cost to drive through tolls, handing control of our public roads to private foreign corporations, and unsustainable debt sweep the state, with more to come unless we make our voices heard.

Concerned citizens from across the state will gather in Austin to interact with lawmakers on transportation-related issues. We’ve seen a massive increase in our cost to drive through tolls, handing control of our public roads to private foreign corporations, and unsustainable debt sweep the state, with more to come unless we make our voices heard.

This is a day when CITIZEN lobbyists come to the Capitol to advocate on what matters to grassroots Texans — like getting an affordable, pro-taxpayer transportation policy in place.

Lots of activities planned:

- a press conference,

- have our group recognized from the House and Senate floor,

- visit offices and speak to legislators,

- lawmakers address TURF group in special Q&A,

- and a special visit from Governor Greg Abbott!

Go to the TURF Registration Page to Register…

Be prepared…

- The public parking garage east of the Capitol is at 12th Street and San Jacinto. If that garage is full another is located north of the Capitol at 18th Street and Congress at the Texas History Museum. Both cost $8/day.

Bring money for lunch. We plan to eat together in the Members Lounge where we’ll hear from some special guests. For a box lunch from Jason’s Deli, the cost is $10. You MUST RSVP by Monday, March 16 to reserve your lunch, otherwise plan on getting lunch in the Capitol Grill (wait times in the food lines can exceed 20 minutes).

Bring money for lunch. We plan to eat together in the Members Lounge where we’ll hear from some special guests. For a box lunch from Jason’s Deli, the cost is $10. You MUST RSVP by Monday, March 16 to reserve your lunch, otherwise plan on getting lunch in the Capitol Grill (wait times in the food lines can exceed 20 minutes).- Bring a notebook to take notes (optional). Fliers, maps and materials supplied by TURF.

- T-shirts with our message will be available. Suggested donation $15. Please reserve your t-shirt ASAP.

We need you!

We need a HUGE crowd to show up to talk to legislators about transportation. There are already some very bad proposals being pushed by special interests (more tolls in the hands of private corporations), and without a grassroots revolt, it’ll sail through without a whimper of opposition. Plan to come and have others join you.

If you’re interested in coordinating a carpool,

contact Terri Hall or call (210) 275-0640.

Public-private transportation partnerships continue to fail around the world. The Spanish-Australian consortium that runs the Indiana Toll Road became the latest casualty seeking Chapter 11 protection in the US Bankruptcy Court for the Northern District of Illinois. On Tuesday, Judge Pamela S. Hollis began hearing the case.

Public-private transportation partnerships continue to fail around the world. The Spanish-Australian consortium that runs the Indiana Toll Road became the latest casualty seeking Chapter 11 protection in the US Bankruptcy Court for the Northern District of Illinois. On Tuesday, Judge Pamela S. Hollis began hearing the case.